Abbott reported higher-than-anticipated results in its second-quarter earnings, spurred by significant growth in its medical device sector. The company recorded a quarterly revenue of $10.38 billion, marking a 4% increase from the previous year. Medical devices emerged as a strong contributor, with sales rising to $4.73 billion, a solid 10.2% year-over-year increase. Notably, electrophysiology, structural heart, and diabetes care sectors notably outperformed during this period.

Despite these positive trends, Abbott experienced a 5.3% decline in net income, which stood at $1.3 billion. The decrease didn’t dampen the company’s future outlook, however, as it subsequently raised its sales and earnings forecasts for 2024. Industry analysts see this move and Abbott’s robust performance as a good omen for the medic technology (MedTech) industry at large, especially contrasting with Johnson & Johnson’s recent shortfall in growth expectations.

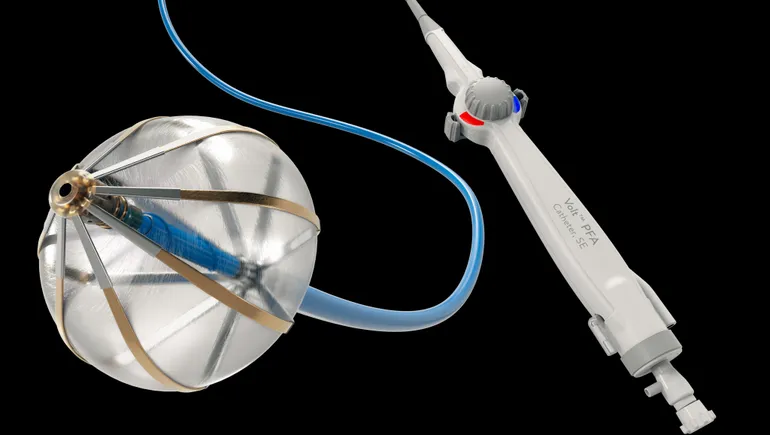

During an earnings call, Abbott’s CEO Robert Ford emphasized the strength of the medical devices segment, crediting it with helping drive overall growth. He touched on recent and upcoming product advances, including in the realm of pulse field ablation (PFA) and glucose monitoring. Despite facing new competition from Medtronic and Boston Scientific in PFA, Abbott’s electrophysiology sales grew by 13%. This emerging treatment, which uses electrical pulses to manage atrial fibrillation and contrasts with traditional thermal-based methods, might potentially apply in up to a third of all ablation procedures. Despite the competition, Ford sees sustained demand and opportunities for expansion, especially as Abbott gears to introduce its own PFA device in Europe next year.

In the arena of glucose monitoring, Abbott has achieved notable advancements with the FDA clearance of two over-the-counter (OTC) continuous glucose monitors, named Rio and Lingo. Rio targets individuals with Type 2 diabetes not on insulin, whereas Lingo is designed for users without diabetes. While sales forecasts for these products weren’t specifically disclosed, Ford highlighted substantial potential, particularly for Lingo, in the expansive U.S. and Western European markets. Learning from their initial launch experience in the U.K., Ford acknowledged a need for continued education and communication to fully realize this potential.

Abbott’s outlook and strategic plays suggest confidence in its future direction despite lingering liabilities tied to legal challenges. CEO Ford firmly dismissed plaintiff claims linking its infant formula to serious health issues, emphasizing the litigation as “without merit” and steering focus back to promising areas of growth and innovation within the medical device portfolio. This dismissal, however, does not completely erase concerns, as the situation points to the often-complex regulatory and legal landscape companies like Abbott navigate.

Robbie Marcus, an analyst from J.P. Morgan, mirrored the sentiments of cautious optimism cited by many regarding Abbott’s capacity to manage current hurdles while maintaining its growth trajectory facilitated by a strong product cadance and procedural backdrop in the medical devices sector.

Overall, Abbott’s upbeat forecast, coupled with its product innovation focus and market strategy for both existing and emerging tech, positions it as a steadfast player in the MedTech field. The company’s ability to innovate in competitive areas like electrophysiology and glucose monitoring showcases a proactive approach to not only sustaining but also expanding its market reach in these critical healthcare sectors.

#Abbott #previews #PFA #overthecounter #CGM #markets